Managing payments to vendors and receiving payments from customers stands as the foremost priority for any business. In the contemporary world, the robustness of our banking system has rendered the use of "Paper Cheques" nearly obsolete, with electronic payments seamlessly integrating into our daily lives. Today, we aim to delve into and elucidate the process of one particular electronic payment method, demonstrating how Dynamics 365 Finance can facilitate its execution.

It’s SEPA – Single Euro Payment Area, let’s first understand something about SEPA. ISO 20022 Credit transfer.

Basics of SEPA

SEPA payments are electronic payment transfers between bank accounts in the euro countries that participate in SEPA.

At its core, SEPA payments involve electronic transfers between bank accounts in the euro countries that participate in SEPA. This standardized system establishes a common set of rules and standards applicable to any organization or individual engaged in euro transactions. Within SEPA, each bank account is uniquely identified by the International Bank Account Number (IBAN), while the associated banks are distinctively identified by the Business Identifier Code (BIC). This framework enhances the ease of money transfers, enabling consumers to seamlessly transfer funds between bank accounts in different countries participating in SEPA.

History

Originating in 1999, the SEPA initiative emerged from the Euro l Bank's vision for a single payments area within the monetary union. The journey culminated in 2007 with the European Union passing the Payment Services Directive, laying the foundation for the Single Euro Payments Area. By 2011, SEPA payments had supplanted national payment systems. Notably, in 2017, SEPA introduced a groundbreaking program allowing participating banks to transfer up to 15,000 euros in just ten seconds.

Further developments in 2018 saw the European Commission proposing extended rules to prohibit banks from imposing extra cross-border transaction fees to non-EU countries. This move aimed to ensure that all EU residents could transfer euros across borders at the same cost as domestic transactions. The proposal also mandated informing consumers about the costs of currency conversion before making payments in a foreign currency.

- In 2019, Vatican City and Andorra join SEPA. (Source: Investopedia)

ISO 20022 : A single standardization approach (methodology, process, repository) to be used by all financial standards initiatives

ISO 20022 is an ISO standard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content. The standard covers financial information transferred between financial institutions that includes payment transactions, securities trading and settlement information, credit and debit card transactions and other financial information.

The repository contains a huge amount of financial services metadata that has been shared and standardized across the industry. The metadata is stored in UML models with a special ISO 20022 UML Profile. Underlying all of this is the ISO 20022 metamodel – a model of the models. The UML profile is the metamodel transformed into UML. The metadata is transformed into the syntax of messages used in financial networks. The first syntax supported for messages was XML Schema.

ISO 20022 is widely used in financial services. Organizations participating in ISO 20022 include: Ripple, FIX Protocol Limited (Financial Information eXchange), ISDA (FpML), ISITC, Omgeo, SWIFT, and Visa. (Source : Wikipedia)

How to use Dynamics 365 Finance to Generate SEPA / ISO 20022 file (Credit transfer) to upload in Bank’s software?

Let's list out the Process first. The following are the steps we are going to follow to generate SEPA / ISO 20022 Payment File.

- Importing ISO 20022 Electronic Report Configuration

- Setup of Method of Payment

- Setup of Bank master

- Creation of vendor Payment Journal

- Generation of Payment

Let’s begin:

Step 1: Importing ISO 20022 Electronic report File format from LCS.

I am using Contoso Data base and DEMF Legal entity for explaining the process.

Go to Electronic Reporting Workspace and Click on Repository. Select Either LCS or Operational Resource to Open Global Generic Document Library / configuration repository.

Find ISO 20022 Credit Transfer and import relevant file.

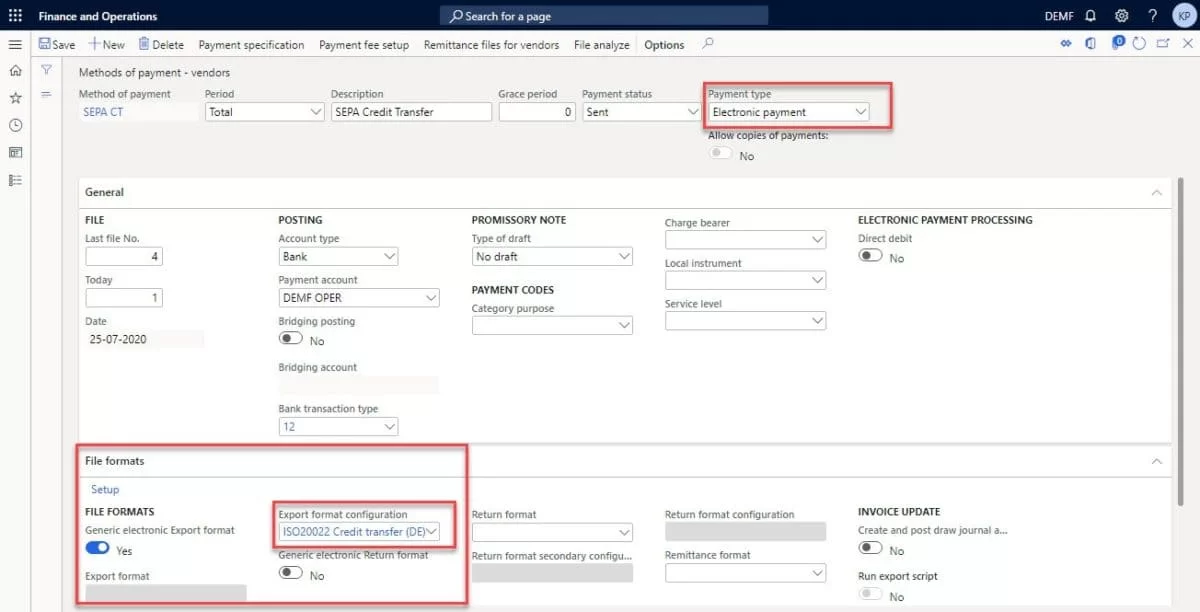

Step 2: Setup Method of Payment in Accounts Payable Module

Go to Accounts Payable > Payment Setup > Method of Payment.

Create new method of Payment with any name (Such as – SEPA CT) and configured in following way and Select the export format as imported from LCS:

once Method of Payment configured, make sure you have bank master with Sift Code and other relevant details.

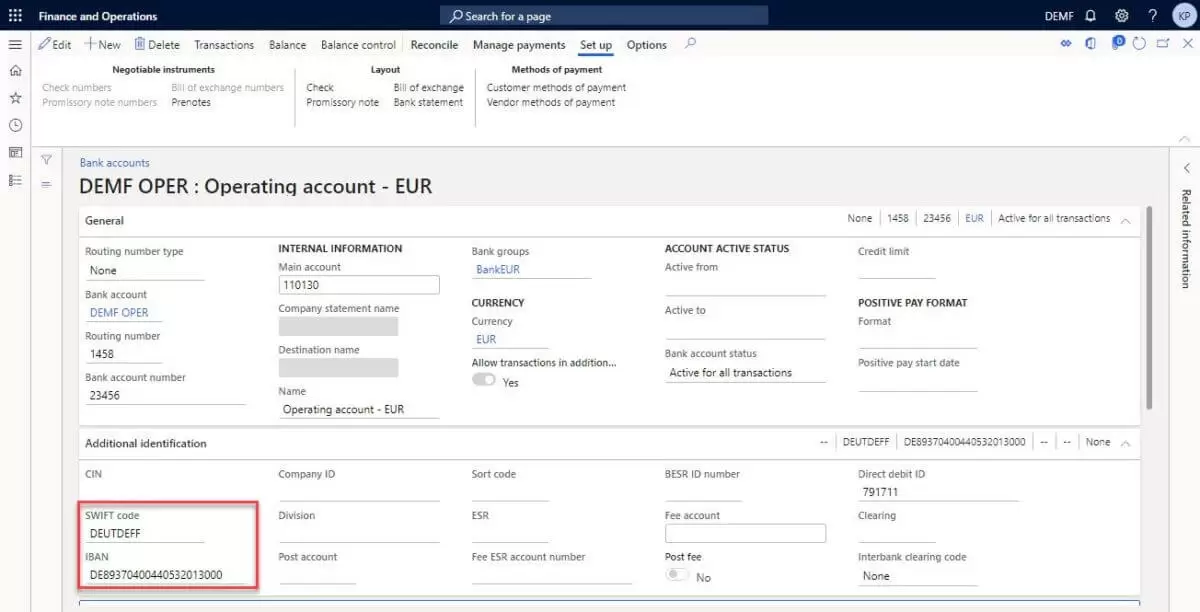

Step 3: Setup Bank Master

Configure bank master in Cash and Bank module and make sure you have provided Sift Code Details.

Once All configuration done, it’s time to start processing payment.

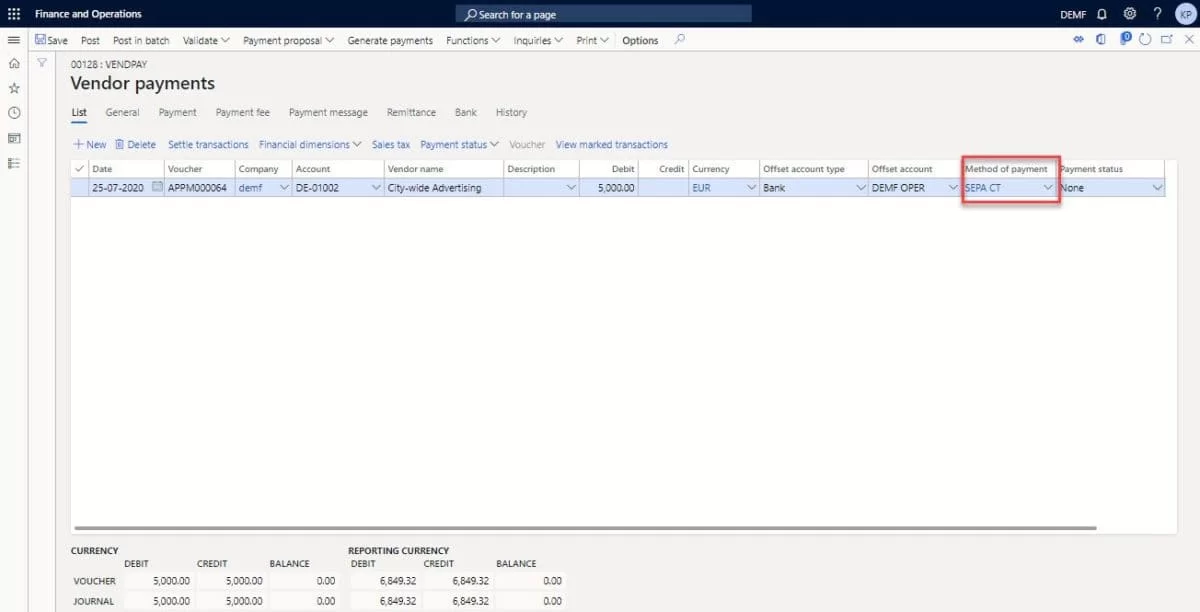

Step 4: Create Vendor Payment Journal

Go to Accounts payable and create one payment journal. Go to the line view select Vendor to whom you need to make payment. Click on Settlement and select relevant invoices or transactions against which you are making payment. After that select Bank Account and Method of Payment which we have created before (in my case it’s “SEPA CT”).

Now, it’s time to generate “Payment File”.

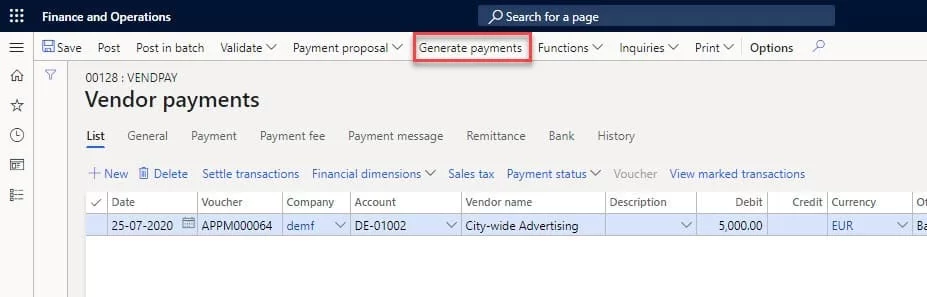

Step 5: Generate Payment File

Now click on “Generate payments”.

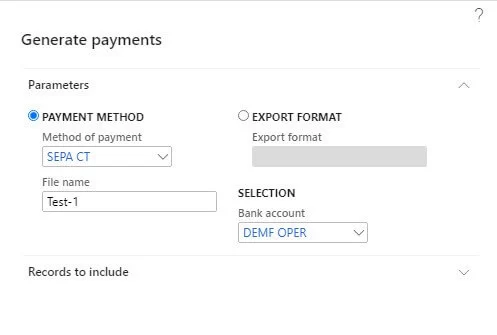

When you Click on it, system will open one Dialogue Box as shown below:

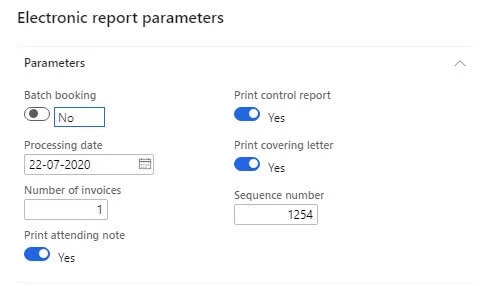

Fill up require details and desired name of file and click “Ok”. After following this step, a dialogue box will open.

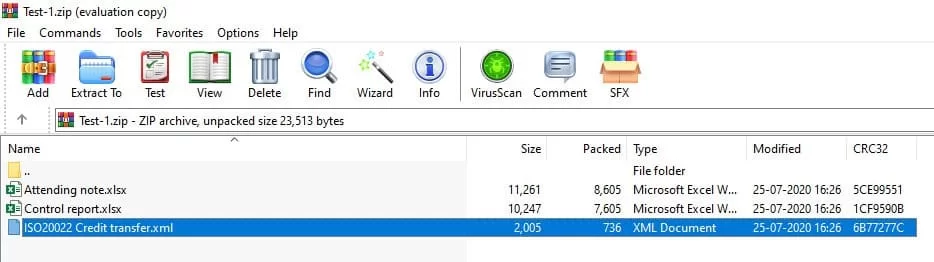

Update required details and click “ok”. The system will generate one ZIP file which will contain a payment file. You need to upload this payment file in the bank software.

Wrapping Up

In summary, the transition from traditional payment methods to electronic transactions, exemplified by the Single Euro Payment Area (SEPA) and supported by ISO 20022 standards, has revolutionized financial operations. SEPA's standardized approach streamlines cross-border payments within the eurozone, marking a departure from paper cheques.

The showcased steps in the blog underscore the user-friendly and efficient nature of Dynamics 365 Finance in enabling businesses to navigate the complexities of electronic payments. By providing a clear guide on file generation, the blog empowers businesses to leverage technology for a smoother, more streamlined financial operation. As we embrace the era of electronic transactions, the integration of tools like Dynamics 365 Finance becomes pivotal, ensuring businesses can not only adapt but thrive in the rapidly evolving landscape of modern finance.

%20Payment%20File%20using%20D365%20Finance.webp)