In the realm of finance operations, the pursuit of efficiency, accuracy, and cost optimization is a never-ending endeavor. The roles of finance teams continually adapt to the prevailing environmental circumstances. Due to the economic pressure, the demand for more work with lesser resources has emerged. And the finance professionals are overburdened with various tasks like analysis, strategy, supplier relationships, etc. along with the traditional processes they perform.

Microsoft Dynamics 365 Finance introduces a game-changing feature: Account Payable (AP) automation. Capturing invoices, processing them, and verifying them, can be a tedious and complex task with various other sub-processes to support the main goal of on-time payments and strong customer relationships. Automating tasks enable the finance professionals to spend less time on repetitive mundane tasks and more on high-value work.

The Current State of Accounts Payable

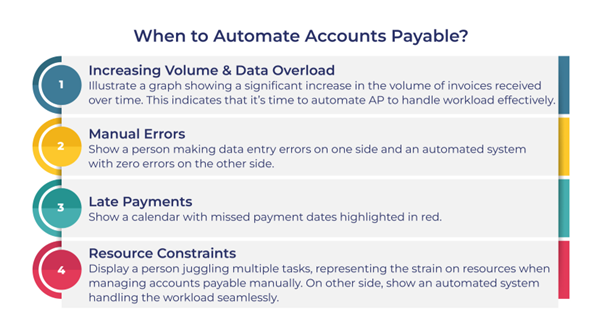

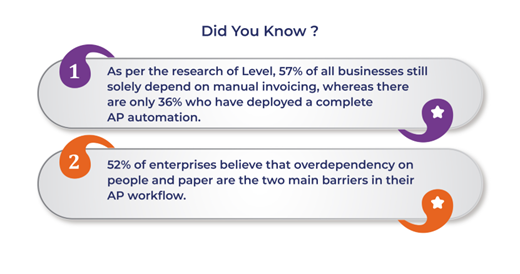

To understand the need for automation in accounts payable, it's crucial to examine the challenges associated with traditional manual processes. Many organizations still rely on paper-based invoices, manual data entry, and complex approval workflows. These legacy processes often result in delayed payments, increased risk of errors, and a lack of visibility into financial transactions.

Amid digital transformation, finance operations are not just limited to moving invoices, but the upper management expects the finance professionals to deliver cost-effective, time-saving, and value-added insights during the business model evolution process.

The Role of Automation in Accounts Payable

- Streamlining Invoice Processing

Accounts payable automation leverages technologies such as optical character recognition (OCR) and machine learning to automate the extraction of data from invoices. This significantly reduces the time spent on manual data entry, minimizes errors, and accelerates the overall invoice processing cycle.

- Intelligent Approval Workflows

Automation allows for the creation of intelligent approval workflows that can be customized based on predefined rules and policies. This ensures that invoices are routed to the appropriate stakeholders for approval, reducing the risk of unauthorized or delayed payments.

- Electronic Payments

Automation facilitates the transition from traditional paper checks to electronic payment methods. Electronic payments not only expedite the payment process but also enhance security and reduce the need for physical documentation.

Achieve Financial Agility with Accounts Payable Automation

Enhanced Efficiency & Time Savings

Manual AP processes are known for their labor-intensive nature, consuming valuable time, and resources. However, with the power of automation in Dynamics 365 Finance, finance operations can achieve unparalleled results.

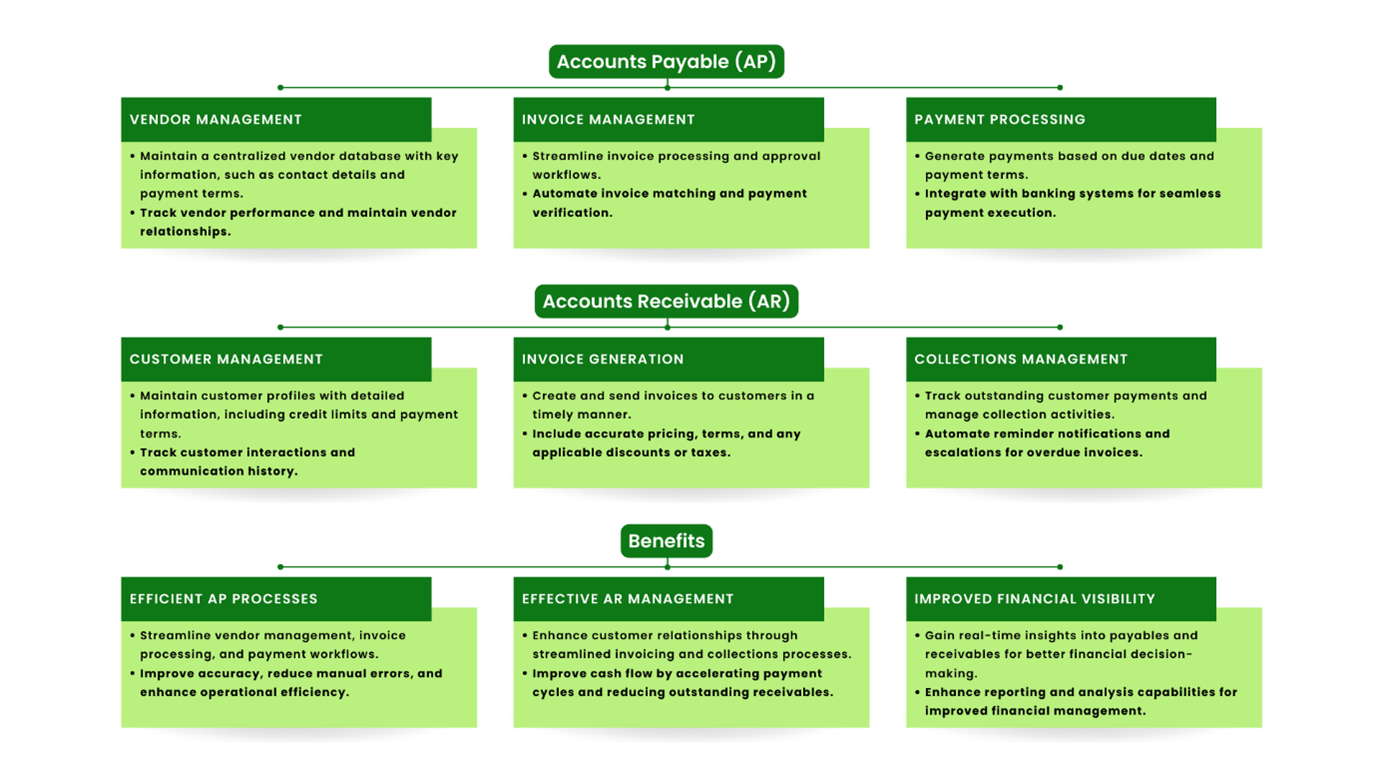

By automating tasks such as invoice processing, data entry, and payment reconciliation, AP automation reduces the dependency on manual intervention. This accelerates the AP workflow, freeing finance professionals for high-value activities like strategic decision-making and analysis. Accounts payable automation in Dynamics 365 Finance minimizes the risk of human error by standardizing processes and introducing automated validations. By automatically matching invoices with purchase orders and receipts, the system ensures accuracy and eliminates the potential for data entry mistakes. The result is more reliable and error-free AP processes, reducing the need for time-consuming manual corrections and preventing costly discrepancies.

Accounts payable automation in Dynamics 365 Finance minimizes the risk of human error by standardizing processes and introducing automated validations. By automatically matching invoices with purchase orders and receipts, the system ensures accuracy and eliminates the potential for data entry mistakes. The result is more reliable and error-free AP processes, reducing the need for time-consuming manual corrections and preventing costly discrepancies.

Strengthened Supplier Relationships

Accounts Payable automation in Dynamics 365 Finance extends its benefits beyond internal operations to external stakeholders, particularly suppliers. Timely invoice processing and prompt payment greatly strengthen supplier relationships. Automation ensures accurate and timely payments, fostering trust and reliability.

Moreover, AP automation provides transparency into payment statuses, enabling effective communication and collaboration with suppliers. By fostering strong supplier relationships, organizations can negotiate better terms, secure favorable pricing, and build a robust supply chain ecosystem.

Compliance & Risk Management

Maintaining compliance with financial regulations and internal policies is a top priority for finance operations. Manual AP processes can inadvertently lead to compliance gaps, increasing the risk of non-compliance and potential penalties.

Accounts payable automation in Dynamics 365 Finance introduces standardized processes and internal controls, enhancing Automated workflows and audit trails provide transparency and traceability, enabling easy monitoring and tracking of AP activities.

Cost Savings and Optimized Resource Allocation

Embracing AP Automation in Dynamics 365 Finance translates into substantial cost savings for finance operations.

By reducing manual labor and paper-based processes, organizations can significantly lower operational costs associated with AP management.

- Additionally, automation enables finance teams to take advantage of early payment discounts, optimize cash flow management, and eliminate late payment penalties. With streamlined processes and improved efficiency, finance resources easily complete their tasks while saving costs and enhancing financial performance.

- Actionable Insights & Analytics

Dynamics 365 Finance, along with the Microsoft Power Platform, empowers finance operations with advanced analytics and reporting capabilities. AP automation unlocks real-time insights into key performance indicators, such as invoice processing times, payment trends, and exception rates. Finance professionals can leverage comprehensive dashboards and customizable reports to gain a holistic view of AP operations, identify bottlenecks, and make data-driven decisions. By harnessing the power of analytics, organizations can continuously optimize their AP processes and drive continuous improvements. - Paperless Ecosystem

As per a survey conducted across businesses ranging from $100 to over $1 billion in annual revenue, more than 50% of all the enterprise's primary goal was to reduce paper. 40% of the average workers’ day is spent finding the paper files. Paper not only increases costs but also damages the eco-reputations and obstructs the AP processes. Going paperless eliminates the need for searching files in cabinets. By storing data in one place, Dynamics 365 enables quick retrieval, streamlining operations. - Intelligent Assistance with Dynamics 365 Copilot

A standout feature of Dynamics 365 Finance is the inclusion of Dynamics 365 Copilot, an AI-powered virtual assistant. Copilot uses natural language processing and machine learning to assist finance professionals in their day-to-day activities. With Copilot, users can interact with the system using conversational language, making AP automation even more intuitive and user-friendly. Copilot can handle tasks such as invoice entry, payment status inquiries, and exception handling, enabling finance professionals with intelligent assistance and speeding up the AP process.

Conclusion

Accounts payable automation in Dynamics 365 Finance presents a transformative opportunity for finance operations, revolutionizing the way AP processes are executed. Organizations adopting this automation can harness the full potential of their finance operations, gaining a competitive edge.

Ready to streamline your accounts payable processes and experience the benefits of Dynamics 365 Finance and automation? Contact us today to learn how our team can help you implement and optimize AP automation to drive financial excellence in your organization. Get in touch with our experts and take the first step towards transforming your finance operations.